THE WEISS

CRYPTO PROFIT CHALLENGE

Part 1. Buy the Right Altcoins to Beat Bitcoin 5 to 1

Part 2. How to Beat the Altcoins Themselves by 4 to 1

Part 3. Beat Bitcoin 20 to 1 Overall

Martin D. Weiss: Hello and welcome to session one of the Weiss Crypto Profit Challenge.

I'm Dr. Martin Weiss, founder of Weiss Ratings, and I can tell you with certainty and abundant proof that investors are making a lot of money in Bitcoin.

Unfortunately, though, many investors remain stuck on the sidelines, unsure of precisely how to get started.

Imagine the frustration of watching an asset that you often thought about buying but never did, an asset you thought might go up two or three times in value but has instead jumped by more than ten times in value just since last year!

All because no one gave you information you can trust!

What about Bitcoin investors who did buy years ago when Bitcoin was worth just a fraction of its current price?

Well, I have news for them … and for you.

Based on what you’re about to learn today, those investors are still leaving about 95% of the potential profits on the table.

Here’s what we’re going to accomplish in this three-part series.

Today, is Crypto Profit Challenge Part 1 — to go beyond Bitcoin and select the right alternative coins (altcoins for short).

That alone will help you beat Bitcoin by 5 to 1.

Tomorrow, is Crypto Profit Challenge Part 2 — to beat the altcoins themselves by 4 to 1 with a tried-and-tested market timing tool. (Click here for immediate access.)

And the final session is Challenge Part 3 — to put both of those together with the goal of beating a Bitcoin buy-and-hold strategy by 20 to 1. (Click here for immediate access.)

If you stick with the Weiss Bitcoin Profit Challenge for the next three days, you’ll acquire the knowledge, the resources — and the confidence — you need to take advantage of this historic opportunity, and you’ll be able to do so, starting immediately.

Your mission?

To start with a modest initial investment that you’re comfortable risking and with the potential to grow it to a level that can transform your financial life for the better.

All with no prior knowledge. No leverage. No frequent in-and-out trading that takes away valuable time from your life.

Let me give you a quick preview of this opportunity by comparing three separate hypothetical investors.

Investor A has bought exclusively Bitcoin. He has never touched and will never touch any other cryptos. He never trades or seeks to time his investment in any way. He simply buys and holds Bitcoin.

And yet, thanks to this great bull market we have today, he does very well. He is able to turn every $10,000 he invests into $100,000. But guess what! He taps only a fraction of the potential profits in this market.

Investor B goes one simple step further. She not only invests in Bitcoin, but she also buys and holds the Magnificent Seven which we’ll name today.

Investor B makes five times more than Investor A. Instead of turning 10,000 into $100,000, she turns $10,000 into $500,000.

But still, Investor B never trades or seeks to time investments in any way. So, she also taps only a fraction of the profit potential.

It’s Investor C who makes the most money of all. Not only does he invest in the Magnificent Seven, but he also trades them based on the simple tools we will reveal in this series for the first time: A crypto timing method based on a scientific, mathematical model that helps you buy low and sell high.

So, by combining both better selection and better timing, Investor C has the potential to make four times more than Investor B, or 20 times more than Investor A.

Instead of turning $10,000 into $100,000, investor C turns $10,000 into $2 million.

That’s a big difference! $2 million instead of $100,000.

But before we say another word, let me answer the question we’re frequently asked by friends and family: "Are cryptocurrencies safe investments?"

The answer: No, especially if you don’t know which ones to buy or when to sell them.

But in this series, we show you two ways to substantially reduce that risk without impairing your profit potential.

- You will learn how to decide what to buy (or avoid).

- And you will learn how to decide when to buy (or sell).

That's what reduces your risk.

So, let's get started and hit the ground running.

You know, right now, there are over 7,000 cryptocurrencies to choose from. But unlike companies, which you may be familiar with because you use their products or services, these assets are much more mysterious. So, how do you determine which ones are worthy of your investment dollars? And which ones you should avoid like the plague?

How to Avoid the Junk

Well, let’s start by avoiding the junk. That’s easy because it’s all on our website. So let me take you there right now.

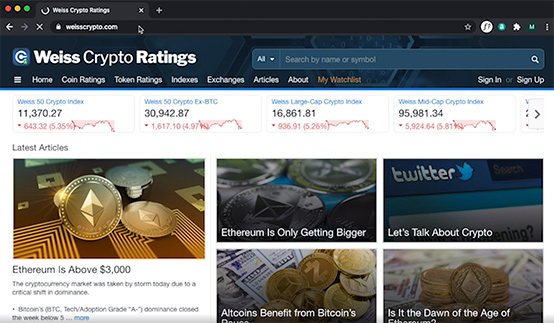

Step 1. In your browser, just type in weisscrypto.com and our webpage should appear. There it is.

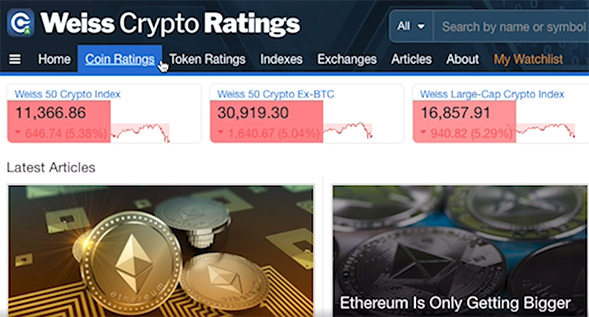

Step 2. In this menu near the top of your screen, select “Coin Ratings” That’s “Coin Ratings.”

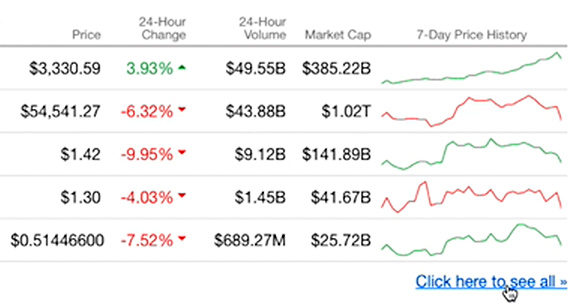

Step 3. It will take you to this page with our current list. Then, here at the bottom of the list on the right, where it says, “See All” Click here.

This table now includes the symbol, the Weiss Crypto rating, the name of the currency, the major components of our ratings plus much more. These are the world’s first and only cryptocurrency ratings by a financial ratings agency, Weiss Ratings. And as with all our ratings in all the sectors, we never accept compensation of any kind from the entities we rate.

And as with all our ratings in all the sectors, we never accept compensation of any kind from the entities we rate.

- That’s why Forbes Magazine called me “Mr. Independence.”

- That’s why Esquire said, “we’re the only ones that have no conflict of interest.”

- And that’s why the U.S. Government Accountability Office, the GAO, The New York Times and The Wall Street Journal recognized the great outperformance of our ratings compared to all of our competitors.

Our independence means unbiased analysis. Unbiased analysis leads to better accuracy. And accuracy is why investors from all walks of life trust what we do.

That also helps explain how our ratings were able to warn investors away from cryptocurrencies near their euphoric peak in 2018, when it seemed everyone was going gaga over crypto.

Plus, it helps explain why we told investors it was finally time to buy again when cryptocurrencies hit rock bottom one year later, precisely when everyone else seemed to hate crypto. So, let’s move on to …

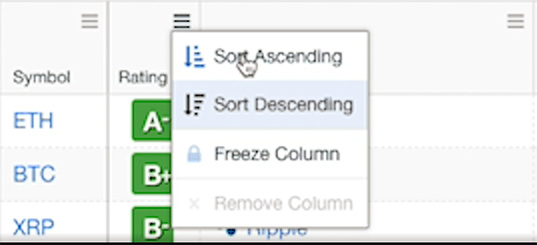

Step 4. To get a list of cryptos to avoid today, press on this small menu button at the top of this column and select “Sort Ascending.”

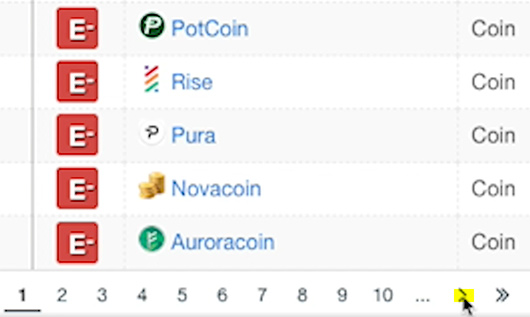

You will then see a list that starts from the low-rated coins, on to the slightly higher-rated coins.

Step 5. If you want to see more low-rated coins, just click here to go to the next page.

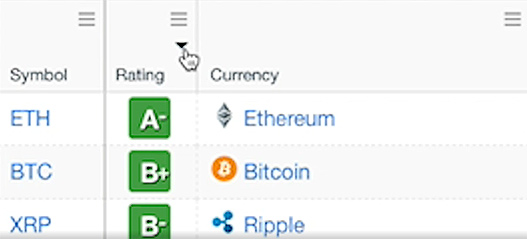

Step 6. This step is very important. So, please pay very close attention. This is where you can start building a list of cryptos to consider for purchase.

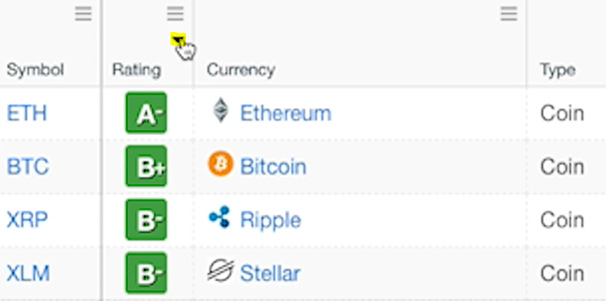

How? Well, the best place to start is right here. I’ll just press this menu button again and sort in descending order, with the highest-rated cryptos at the top of the list. Any cryptocurrency that merits a Weiss Rating of B- or better is in the green, which means buy.

And here are the top six: Ethereum, Bitcoin, Litecoin, Ripple, Stellar and Cardano.

These are ranked based on our overall rating, which you see here in the second column in green.

- The first subgrade is our Tech/Adoption Grade, which looks at each coin’s fundamentals: How strong is its technology and how much is it actually being used or adopted in the world.

- The second subgrade is our Market Performance Grade, which weighs the risk and reward of investing today, based primarily on market price movements.

So, since you’re here with me right now, as an extra benefit for attending, let me give you a tip based on our own internal analysis of the subgrades and the data behind them.

Thanks to some information you cannot see on this screen, our analysts have flagged two other coins to add to this list: Monero and Chainlink. And that’s what gives us the Magnificent Seven beyond Bitcoin:

Ethereum

Litecoin

Ripple

Cardano

Stellar

Monero

Chainlink

So, why not just buy Bitcoin? Well, first because Bitcoin alone does not give you diversification.

All the coins on this list are different, and many were created for very different functions.

Bitcoin: As you know, Bitcoin was originally designed to be a new kind of money, a new kind of currency. But did you know that's not its primary function today.

You see, as it turned out, Bitcoin has become mostly a store of value and a refuge for investors who fear the consequences of all this Fed money printing.

In other words, Bitcoin has emerged as a kind of digital gold, or gold 2.0. That’s Bitcoin’s primary use-case today.

What about the other cryptocurrencies on this list? Well, this is what often confuses many people.

Because some cryptocurrencies are not really intended to be currencies at all.

They’re other kinds of digital assets, and often the only thing they have in common with Bitcoin is that they’re based on the same technology that the creator of Bitcoin introduced — blockchain.

So, don’t view these new cryptocurrencies as currencies. Instead, look at them as new technologies.

A new more advanced and secure kind of Internet.

A new more advanced kind of banking system.

A new more advanced kind of stock exchange.

New kinds of organizations that are not controlled or manipulated by any central authority.

Take Ethereum, for example. It’s often described as the paramount world computer, where everyone has access to the same open, public database. It is the first and largest blockchain that supports a wide variety of internet applications using what’s called smart contracts.

Chainlink: is also entirely different.

It helps connect the real-world data from the financial markets to the blockchain.

This supports a whole new, more efficient, more secure peer-to-peer financial system, called Decentralized Finance, or DeFi.

And this new financial system, by the way, has already grown from less than $1 billion in assets to over $60 billion in assets, all in just one year.

Monero: is another thing entirely. Monero is the leading coin in a brand-new world of privacy, giving its users and investors a whole new level of protection from snooping eyes.

XRP: is also very different. It’s a crypto that’s managed primarily by the Ripple company. It doesn’t replace dollars, but it does compete with Western Union and with traditional bank wire transfers.

Stellar? Very similar to Ripple. But unlike Ripple’s XRP, it’s not managed by any company or centralized organization.

Litecoin: is the only one in this group that’s essentially a clone of Bitcoin, but it has the advantage of bigger supplies and much faster transaction speeds.

So, diversification is the first big reason to go beyond strictly Bitcoin and to also look at the best altcoins, especially the coins on our list of the Magnificent Seven.

But it's definitely not the only reason to look beyond Bitcoin. Another reason is the far larger profit opportunities that altcoins can provide in rising markets.

Consider what happened in the last bull market like this one, for example. If you bought Bitcoin in the last bull market, yes, you could have certainly made a lot of money.

From its bottom in 2015 to its peak in 2017, Bitcoin rose 11,461%. In other words, just by buying and holding Bitcoin, you could have multiplied your money 115 times over.

An initial investment of $10,000 could have turned into $1,150,000.

But even bigger gains were possible with our highest rated altcoins. For example, instead of buying Bitcoin, if you had bought Stellar, you could have seen a gain of 20,656% or more than 207 times your money.

An initial $10,000 investment could have turned into about $2,076,000.

Or, if you bought Stellar’s direct competitor, XRP, you could have made a bit more. There the gain was 21,718% or about 218 times your money.That turns $10,000 into $2,180,000.

Litecoin did even better.

You could have seen a gain of 25,740%, or 258 times your money.

An initial investment of $10,000 could have turned into $2,580,000.

What about Monero? Well, there you could have seen a gain of 146,338% or 1,464 times your money.

You'd be talking about turning $10,000 into $14,464,000.

And that was in the crypto bull market from 2015 to 2017.

Now, fast forward to today, and we see four powerful reasons why the current bull market has the potential to be even bigger.

Reason 1 The Fed — the good old Fed — has just printed $3.6 trillion in fresh new money to pump into the economy, and it’s vowed to keep printing more money for years to come.

For investors around the world who have nearly all their money in dollars or dollar-denominated assets, that’s scary as all hell. And it’s driving them to rush into crypto.

Care to guess how much money the Fed printed during the last crypto bull market? Nada.

Zilch.

That's right. Between 2015 and 2017, while Bitcoin was going up so high as I explained a moment ago, the Fed did not add a dime to its balance-sheet assets, which is the way we measure how much money printing they did.

Reason 2 is big institutions. In the last crypto bull market, they had virtually zero interest in cryptocurrencies. They thought Bitcoin was useless, worthless, or even less than worthless. Warren Buffett even declared to the world that Bitcoin is “rat poison squared,” but this bull market is very different.

In this bull market, the big players are jumping in: Tesla, Fidelity, Goldman Sachs, Morgan Stanley, PayPal, Master Card, Visa, plus many more.

Reason 3 is the blockchain technology itself.

Last time around, it was still in its infancy, with a lot of false starts and even fake projects, kind of like the early dot-com days when no one could figure out how to make real money with the Internet.

Now though, blockchain has far broader and bigger practical applications, including the Decentralized Finance I mentioned a moment ago, which is creating a brand-new financial system on the blockchain, which has grown 60 times in just one year.

Reason 4 brings this back to you, the individual investor.

Last time around, it was very hard for individual investors to get into crypto. Just to open a crypto exchange account was a royal pain in the butt. Today it’s far, far easier.

And when crypto ETFs become available, you can expect another big flood of money into cryptocurrencies.

So, that gives you four powerful forces that could make this crypto bull market even bigger than the last one, which means it still has a long way to go.

Which Cryptos Will Ultimately

Be the Biggest Winners of All?

So far, we see a pattern that’s similar to the last bull market.

Our highest-rated cryptos are among the few that are truly leading the pack.

If you had bought Bitcoin when we declared bottom in December of 2018, the beginning of this bull market ... and you simply held it till now, you’d have a gain of 1,865% or over 19 times your money so far.

A $10,000 initial investment would now be worth over $190,000.

Nothing to complain about, right?

But if you had bought Ethereum on the same day, you could have a gain of 2,623% or 27 times your money.

Starting with $10,000, you could have more than $270,000.

Right now, so far.

What about Cardano?

Well, you could have put the gains in both Bitcoin and Ethereum to shame. Instead of 19 times and 27 times your money, you'd be looking at nearly 50 times your money.

If you invested $10,000, you'd have almost a $1.5 million right now.

Why not the 100 or 200 times your money like we saw in the last bull market? Because, as I said, in terms of price levels, it’s still very early in this bull market.

If it follows the same basic pattern as previous bull markets, the truly parabolic move will come in the last few months.

So, based on our research, you have not missed the party.

You’re not too late.

Quite to the contrary, the best part has yet to begin. Suppose you never got our buy alerts at the bottom of the Bitcoin market in December of 2018 — the beginning of this bull market?

Suppose you never saw all of the many buy alerts we’ve sent out ever since.

Or worse, suppose you’re among the latecomers to crypto that began investing on January 1st of 2021? Could you still be making a lot of money? Absolutely!

From January 1, 2021, through today, Cardano is up 677% or 7.8 times your money.

Ripple is up 716% or 8.2 times your money.

And Monero is up 1,896%.

That’s nearly 20 times your money.

So, here we are now, at the tail end of Step #6, picking the best cryptos.

Now, do you see why this step is so important?

Now, do you see why I want you to learn how to build a solid list of cryptos to buy?

Given the tremendous advantages that our highest-rated altcoins can give you in rising markets, I think it’s pretty obvious.

Step 7. WHERE to Buy

So now, let's move on to Step #7 — and that is to learn where to buy the cryptocurrencies.

Even if you already have a crypto exchange account, I think you will find this discussion very informative.

First of all, you cannot yet buy cryptocurrencies from your securities broker.

Sure, there are some specialized funds you could use, such as those operated by Grayscale. So, if you’re in a big hurry to buy before opening an exchange account, that’s a possible shortcut.

For Bitcoin, you can use the Grayscale Bitcoin Trust, symbol GBTC.

And for Ethereum, they also have the Grayscale Ethereum Trust, symbol ETHE.

But I must warn you:

- The premiums they charge can sometimes be outrageously large. And …

- The trading volume of some of these funds, especially ETHE, can be very, very thin.

Could you wait for cryptocurrency ETFs to become available?

I guess so, but by that time, it’s very possible that crypto prices will be a lot higher, and you will have missed most of the opportunity.

In fact, just the expectation in the market that some new ETFs might be launching could, in and itself, drive up crypto prices very sharply long before you could actually buy the ETFs.

So, we don’t think it’s a very smart move to wait for them.

We believe you’re much better off buying now well before the ETFs are launched.

And the only way to do that is by opening an account in a cryptocurrency exchange.

For this session, let me walk you through …

3 Cryptocurrency Exchanges:

Kraken, Coinbase and Binance.com.

All three are well-established, reputable and trustworthy.

And all three offer a very different range of services from the least to the most.

Unfortunately, however, the quality and quantity of the services they offer cannot be your first criteria for making a choice.

Instead, the first thing you've got to consider is where you live.

Coinbase

If you live in New York State or Washington State, consider Coinbase. It offers nearly all of the cryptocurrencies we'll be covering in this course. It's available in all states of the Union. Plus, it makes it easy to transfer money from your bank account.

- Just go to Coinbase.com.

- Enter your e-mail address.

- Click on “Get Started.”

The rest is pretty easy, no more difficult than opening a basic online brokerage account.

I like Coinbase because it lets you transfer funds from your bank account online straight into Coinbase.

Kraken

Now, if you live anywhere else besides New York State or Washington State, Kraken offers some advantages:

- It's chartered as a U.S. bank.

- It has a broader list of cryptos.

- Its fees are lower, and

- It usually provides better customer service.

But to transfer funds, you'll first need to go to your bank.

To open an account …

- Point your browser to Kraken.com.

- Simply click on “Accept Cookies” ….

- And then on “Get Started.”

- Create your account by entering your e-mail address, password, country of residence state, etc.

Binance.com

If you live outside of the United States, then seriously consider Binance.com, which has the largest list of cryptos to buy and the widest range of services.

- Just point your browser to Binance.com.

- Click on this yellow button “Register Now.”

- It gives you the option to register with your e-mail Or …

- If you click on “Mobile,” it also gives you the option to register with your cellphone number.

- Then, just type in your e-mail, create a password and click on this yellow button on the bottom, “Create Account.”

The rest of the steps should be equally self-explanatory.

But remember, Binance.com is currently not available to US residents.

So, if you wind up on this page, Binance.us, with this logo at the top ... you're in the wrong place.

Make sure you go to Binance.com.

No Complicated Formulas.

Nothing out of This World.

It’s that simple.

In fact, all the steps I’ve walked you through in this session are relatively easy. No complicated formulas. Nothing exoteric or out of this world.

And already, in this one free session, I think you’ve accomplished a heck of a lot.

- You've learned how to greatly reduce your risk, simply by avoiding cryptos with low Weiss ratings.

- You’ve learned how to multiply your profit potential by selecting the cryptos with high Weiss ratings. And …

- You've learned what to avoid, what to buy and where to buy it.

But now it’s time to learn …

- WHEN you should buy each crypto to pick up the best bargains, and

- WHEN you should sell each crypto to reap the best profits.

Remember: The steps we’ve covered today are based exclusively on a strategy of buy-and-hold. All with no notion of timing. All with no timing model to guide you.

As you’ve seen, even without a timing model, the profits were still very substantial.

So, imagine how much money you could make WITH an accurate timing model.

That’s the subject of our next two sessions. And I think you will be pretty amazed at the enormous difference they can make.

- In Cardano, for every $100,000 in gains others might make by just buying and holding, in our next sessions, we'll demonstrate how you could be looking at more than $294,000 gains.

- In Ethereum, for every $100,000 that others make just buying and holding, we'll show you how you could make $466,000.

- With Litecoin, for every $100,000 made using a buy-and-hold strategy, we'll demo how you could be making over $572,000. And …

-

Look at Ripple’s XRP! Whatever you could make with buy and hold, multiply that 9.6 times by using our crypto timing model.

That means for every $100,000 in gains that others could have made, you'd be looking at $960,000 in profits.

Or instead, let’s say, $1,000,000 in gains … you could be making around $9.6 million.

So, what are the steps to take to achieve this extreme outperformance?

We walk you through each of them, one by one, in our next sessions together.

Normally, this kind of exclusive information is not available to the public. Either that or it can cost thousands of dollars to gain access.

However, with crypto prices moving into what we believe to be the most exciting and wildly profitable phase of this bull market, we’ve decided that we don’t want anyone to be left behind.

Let me explain. For 50 years, my research and ratings company have been here to guide investors to financial freedom – and in all that time, I have never seen an opportunity quite like this one.

A chance for virtually anyone with the right tools and knowledge to make truly life-changing profits.

That’s why I’ve given you this first session of our Crypto Profit Challenge for free. And it’s why I want to also give you immediate access to our NEXT two sessions, our more advanced training.

Not for the thousands of dollars that others might pay for this kind of training. Not even for hundreds of dollars.

Instead, I want to give you everything you need right now for just $29.

Simply, click here to continue this journey with me.

You’ll get the next two sessions.

And you’ll multiply your profit potential by up to 9.6 times. Instead of profit potential of $10,000, you’d be looking at $96,000. Or instead of $100,000, you’d be looking at $960,000, nearly one million dollars.

But you must act fast! Because this opportunity is available only to those who have completed this free training – and only for a limited time.

I trust this has been a valuable learning experience for you, and I look forward to seeing you here again when we dive into session #2, and session #3.

Stand by, while I take you to our website for more information right now.

Good luck and God bless!

Martin D. Weiss, PhD

Weiss Ratings founder