SUPERYIELD WEBINAR

How to Immediately Start Earning Some

of the Highest Yields of All Time

by Founder Dr. Martin D. Weiss

and Expert Yield Hunter Marko Grujic

To get all the benefits now, jump here.

Or read on for the full transcript …

Martin: Hello and welcome to our first-ever, real-money demonstration of an income opportunity that’s virtually out of this world!

Today, we’re going to show you how to earn much higher yields on your money than you can get with stock dividends or bonds.

And, we’re going to show you how you can do it with much lower risk.

You’ll soon understand why I’m investing $100,000 of my own money in this opportunity immediately … and why I plan to invest another $900,000 very soon.

And you’ll see how, at current rates, my investments in this opportunity should give me about 20% interest or $200,000 in pure yield per year.

Add in the profit potential beyond that interest yield, and we could be looking at a lot, lot more.

Before we’re done today, we’ll show you how you can access three opportunities — one for high yield, one for high profit and one for both high yield and high profit.

I’ll explain all the ins and outs in a moment.

But first, you need to see this for yourself, with real money, in real time!

I’m here with my friend, Marko Grujic.

Marko has more experience in finding these super-high, safer yields than anyone I know, and that’s why I’ve asked him to join us today.

Marko, let’s jump right in.

In just a few minutes, I’d like you to show me, on screen, what kind of yield I can get right now. You have access to my online account, right?

Marko: I have it open and I’m ready to show it to you.

Martin: Go ahead and show me and everyone watching how much we can earn right now.

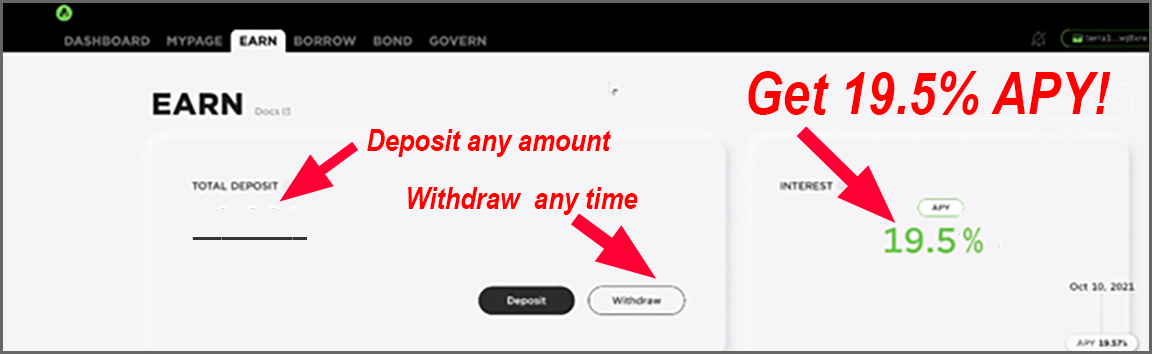

Marko: So, the expected interest is: 19.5%.

Martin: Wow! So, if I deposit $1,000, I could earn about $195? And if I deposit $1 million, I could earn what… $195,000?

Marko: Yes, you can live just on your interest, Martin.

Martin: That’s assuming yields stay the same, of course. If they go up, I guess I could earn even more, and if yields go down, naturally, it would be less.

Marko: That’s right. But this yield has been pretty stable for about five months and they’re averaging between about 19% and 20% APY.

Martin: So about 19.5% on average! That’s mind-boggling, Marko! Can you show that to me right now? Can you prove it to me?

Marko: So, as you can see, we are here on the platform.

You can see our yields. We just need to deposit to get them straight away.

Martin: The 19.5% number on screen — that’s the yearly percentage rate? That’s way more than I can get on investments that are a lot riskier.

Heck! Last I checked, the average high-yield bond is yielding only 4.4%. And everyone knows “high-yield” bonds really means junk bonds, which can be risky as hell.

So, this opportunity you’re showing on your screen is about what? FOUR times more than I get on junk bonds?!

Marko: Yeah, that’s correct.

15x Higher Yield

Than Stock Dividends

Martin: And stock dividends? They’re yielding even less!

Billions of income investors have been chasing all around for stock dividends with an average yield of about 1.3%. So, this yield opportunity you just showed us is 15x greater, right?

Marko: Yeah, that’s exactly right.

Martin: I just want to confirm one thing…

This 19.5% yield you just showed us, that’s without the risk that the price could go down sharply and jeopardize my principal, correct?

Marko: Confirmed. Because the asset we’re using is a stablecoin. An asset that’s designed not to fluctuate in price, just like the U.S. dollar.

Martin: It kind of reminds me of a money market mutual, fund where the share price is pegged to $1. That share price doesn’t got up or down, and the interest is paid in those same shares.

Instead of putting cash into your account, they give you more $1 shares.

If there’s two dollars in interest, they give two shares. If there’s $100 in interest, they give you 100 shares. Is this basically how this works?

Marko: This is not a money market fund, but the basic concept is the same.

Martin: Bottom line: I get nearly 20% yield with little or no price volatility.

Marko: Correct. So, are you ready?

Martin: You mean, ready to go ahead right now and do this?

Marko: Sure! I helped open this account for you. You’ve funded it with your money, with your stablecoins. Now all we need to do is press a couple of buttons, and you can grab this yield right now. So, are you ready or not?

Martin: Sure, I’m ready.

Marko: How much do you want to deposit?

Martin: Well, as this is a test, let’s just do $1,000.

Marko: Press “Deposit” here and we go for $1,000. We are paying a fee of $2 to do this, but in a matter of seconds, it’s all done.

The account setup and funding took several more steps. But that’s all done now. So, you don’t have to do it again.

Now, any time you want to deposit more, or you want to withdraw some money, all you’ve got to do is press a couple of buttons like we did just now.

Martin: But my first $1,000 is already deposited?

Marko: Right, your first $1,000 is already earning 19.5% right now.

19.5% Yield with

Almost No Price Risk

Martin: When will I see my first interest payment?

Marko: On this platform interest is paid daily so probably by tomorrow, if not sooner.

You see, this is not like banks, brokers, or the traditional financial system. Like you said earlier, it’s virtually out of this world.

Martin: Yes, it is really virtually out of this world. I’ve heard a lot about this. My team and I have been talking about it for many moons.

And I knew the interest rates were a lot higher than what we can get in a bank CD or a money market. But 19.5%?! That’s a lot more than I expected.

Marko: But here’s the thing, Martin. What we just did — the 19.5% yield — is what we call “Level 1.” You can get even better yields, plus big profit potential on Level 2.

Martin: Hold that thought, Marko, because first I will take a moment to explain to our viewers what this is all about and how it’s possible, OK?

Marko: Sure. Go ahead. Just be aware that with many of these opportunities, you cannot wait too long. When they appear, you’ve got to nail them down while you can.

Marko: OK, I’ll make it quick. Jump in if you need to add something, all right?

An Entirely New Way to

Earn Investment Income

The main reason these yields are so high is because we’re doing an end run around the traditional financial system.

Sorry to be so blunt, but the fact is the financial system, as we know it today, is deliberately and callously… ripping us off!

Every wage earner and retiree — in America and around the world.

Every one of us — saver, investor, taxpayer … rich or poor … savvy or uninformed — every one of us is a victim of what I call the banking-brokerage complex.

Banks and brokers spend money like there’s no tomorrow — on palatial office buildings, lavish bonuses for their salespeople, bigger bonuses for their traders and absolutely scandalous compensation for their top officers.

Ken Lewis, CEO of Bank of America made $25 million.

Gregory Fleming, CEO of Merrill Lynch made $27 million.

Jamie Dimon at JPMorgan made $28 million.

And look at these four Goldman Sachs executives:

David Viniar, CFO — $58 million.

Lloyd Blankfield, Jon Winkelried, Gary Cohn (CEOs and COOs) — upwards of $70 million.

Each! All in just one year.

All while their ordinary customers get screwed!

They take our money. They give us practically nothing in interest! And then they charge at least 20% per year on credit cards.

Or worse, they use our money to trade in the high-risk derivatives market for their profits.

That’s dangerous. And if you don’t believe it, just look at what happened in the Great Debt Crisis.

The root causes of that crisis have not been fixed. Banks are still pulling the same old tricks.

And you know what? It’s not really their fault. They’re just naturally exploiting an environment that’s been created for them by the Federal Reserve and the central banks all over the world.

But if you think that’s bad, you should see what happens in the brokerage industry. Brokerage firms are even deeper into dangerous derivatives, especially interest-rate derivatives.

And that’s only half the story. The other half of the story is how they abuse average investors. They routinely encourage you to buy the garbage that they’re trying to get rid of.

For many years I’ve tried to fight this system.

I testified before Congress multiple times. I wrote white papers. I’d even shout from the rooftops if I thought it could make a difference.

But it doesn’t. The solution we’re talking to you about today does. It does make a difference. A huge difference.

With the solution we have before us today, we can say goodbye to banks. We can say goodbye to Wall Street brokers. And we can politely find a way to tell the Fed to go to hell.

A New World of Banking

Then, we move on. We move on to an entirely new world of banking.

An entirely new world of brokerage and finance. A world that’s controlled by no central organization. No big corporation. No big government.

We move to the world of Decentralized Finance, or DeFi for short.

All living in the ultra-secure, ultra-private world of the blockchain. Not Bitcoin. But using the same basic tech as Bitcoin.

That’s where we got these super-high yields that beat stocks and bonds by a country mile. That’s where we can thumb our noses at the big bankers and brokers of the world.

Why? Because with Decentralized Finance, we cut out the middleman.

So your yield does not get clipped and dinged every day of the year with their crazy costs.

So no one takes a big slice of the money you earn to pad their own bottom line.

So there’s no bank, no intermediary, no one standing between you and your money.

But it’s even more than that. With this simple move we achieve three very constructive goals…

- We escape the trap we’re in right now, the trap of earning practically zero in interest on our cash.

- We don’t let the value of our money go to hell in a handbasket.

- And we play a role, however small it may be, to help avoid the next great financial crisis, not only for our own sake, but for the benefit of all concerned.

Now, a lot of investors are unhappy with the crappy yields they’re getting on their savings.

But that’s only half the story. What many people don’t realize is that they’re also taking HUGE risks with their principal.

Decentralized Finance provides a solution for that problem too.

Why I’m Moving Money from the Traditional World of Saving and Investing

Let me show you the risks you’re taking with stocks and bonds:

This is U.S. high yield index — the yield you can earn on junk bonds.

The current yield is about 4.4%. That’s one-fourth yield I’m getting on my crypto deposit.

But what I want to point out now is not just the crappy yield you get on junk bonds. It’s also the big risk you’re taking that the value of your principal could collapse.

Remember: The 19.49% I’m getting now in crypto yield is with little or no price risk.

Strictly with a stablecoin, a stablecoin that is pegged to the dollar, one to one, that does not expose my principal to price risk.

But take another look at the junk bond chart above.

Look at how the yield surges and plunges wildly! And here is the thing …

When bond yields rise it means their price falls.

Up in yield means down in price. And vice-versa.

So, let’s say I buy these bonds now. I lock in around 4.4% yield. And let’s say the yields double — to about 8.8%.

I’m NOT going to be very happy. Because my old, lower-yielding bonds are going to plunge in value by 50%.

Unusual? Heck no!

That’s what happened in the pandemic crisis of 2020.

The price of all bonds, especially junk bonds collapsed.

When junk bond yields surged,

their market value collapsed

Anyone who bought bonds before the pandemic hit saw their bonds collapse in value. By more than 50%!

That does not happen with stablecoins.

And yet, I must remind you, with stablecoins, I can earn FOUR times more yield than I can get with these high-risk junk bonds.

What about stock dividends?

Here’s the dividend yield on the S&P 500.

We’ve talked about how darn low it is. A meager 1.32%.

We’ve talked about how, right now, I’m earning 15 times more than that. But that’s only half the story. The bigger problem is the huge threat to your principal.

Low Dividends Can Foreshadow

Major Stock Market Crashes

Historically, extremely low dividends have been a tell-tale sign of a future crash in stock prices.

On the day before Black Tuesday 1929, the day the market suffered its worst crash in history, dividend yields had hit a 50-year low of just over 3%.

That’s when the market crash began.

Ditto for the day before Black Monday in 1987, a crash day far worse than the Black Tuesday of 1929. Dividend yields again went back to just under 3%.

And it happened again before the pandemic of March 2020, when dividend yields fell to around 2%.

What about now? They’re even lower!

That doesn’t necessarily tell us the stock market is going to crash tomorrow. But it does tell us about the one thing we want to avoid: HIGH RISK.

These low dividend yields are not only sick, they’re dangerous. They’re the harbinger of the next Black Monday or the next Black Tuesday.

But like you saw earlier, my yield is 15 times better and without the risk of crashing prices.

So, let’s say you want NO risk whatsoever. Let’s say you want to just earn as much as you can without any chance that your principal could get shellacked.

What do you do? You go to your bank, right?

You plunk down at least $100,000 in a certificate of deposit. And you lock it up for the longest period they’ve got — in the five-year Jumbo CD.

How much can you make?

For the answer, let me take you to the website run by our old friends at Bankrate.com.

The five-year jumbo CDs give you THE best CD deal you can get in the United States today.

How much are they paying?

A meager 0.29%!

That’s right, less than one-third of a percent!

My Stablecoin Pays Me 67x More

What’s more, if I’m willing to accept market price risk with some of my principal, Marko says I can make even more.

Martin: Marko, let’s pick up from where we left off. You said that the 19.5% yield was just our first step into this great new world of Decentralized Finance.

Where you assume little or no risk of price declines that could affect your principal.

And what we’ve talked about so far strictly uses assets that are pegged to the U.S. dollar — stablecoins. Almost like a money market fund that’s always $1 per share.

Marko: Not entirely the same, but yes, almost like that.

Martin: Now let’s step this up. Show me what I can get if I’m willing to take some risk. Just remember, Marko, this is not a game. You’re investing real money, my money!

Marko: Of course. And I will do so with the utmost care, always mindful of the fact that you don’t like risk.

Martin: I can handle some risk. But I like to keep a big chunk of my money liquid and safe.

Marko: Sure. Well, in this session today, we’re exploring three different yield levels.

Three Levels of Yield,

Three Levels of Income

Level 1 is already in place. You’ve made your deposit. And you’re already earning rich yields. 19.49% to be exact.

Martin: Okay, please show us an example of Level 2.

Marko: Sure. I’m logged into your account. It’s funded and ready to rock.

Martin: First, though, let me tell our viewers what we’re going to do here.

Instead of depositing my money in a single digital asset, we’re going to deposit my money in a PAIR of digital assets. Since this is on the blockchain, we call them “crypto pairs.”

One crypto in the pair is a stablecoin. And like we said, its price is pegged to the U.S. dollar. Its price is designed not to fluctuate.

The other crypto in the pair is not a stablecoin. Its price does go up and down.

Any money we deposit is automatically split 50-50 — half of the money in the stablecoin, half in the regular coin. So, the idea is that we get the best of both worlds.

- 50% of my deposit pays me interest only.

- 50% pays me interest and also fluctuates.

So the second half of the pair does involve risk of a price decline, but the aim is to pick cryptos that are most likely to go up in value.

Even if it only goes up a few percentage points, it can give me a nice extra kicker over and above the yield.

Did I describe that accurately?

Marko: Yes. So, now let me show you exactly what it looks like and how much yield you can make.

We are going for this pair, which gives 40.9% yearly return. On $10,000, you’d make about $4,000.

Martin: Wow! 40.9%, almost 41%. And I thought the 19.5% we got on Level 1 was extremely high.

Marko: This is much higher. But as you’ll see in a moment, it’s actually one of the lower yielding opportunities in this category.

Martin: God! Now, you’ve really got to be kidding me.

Marko: Not at all. But I’ll get to that in a minute. The two cryptos you’re depositing here are Solana and USDT.

Martin: That’s one of the cryptos that our crypto rating and timing specialist, Juan Villaverde, recommended recently to our subscribers. It promptly doubled in just a few weeks. He got our subscribers out with nearly a 100% gain.

Marko: Right. So, imagine what you could do holding on to this for a few months!

Martin: You’ve really got to stop doing this to us. Every time we think this is as good as it can get, it gets better.

Marko: How much do you want to invest this time?

Martin: Same as before — $1,000.

Marko: Okay. We press “Deposit” again. We click on our USDT balance, and it will sort everything 50-50 for us automatically.

Martin: So, they’re putting half in SOL and half in USDT in terms of dollar value?

Marko: Exactly and we can see our estimated earnings from fees in seven days.

Based on $1,000, we’re talking about $33.38 per month, or yield of 40.9% APR.

Now, we click “Deposit.” We will approve the transaction in our wallet. And it’s done. Our deposit is complete. So, you are now earning 40.9% APR.

And you can see that we already got some rewards. You can see the numbers are compounding as we speak.

Martin: So, in Level 1, we had to wait a day or maybe until the next day before we saw any interest payments because they pay daily. And this one?

Paid Instantly, Every

Second of Every Day

Marko: This one is compounding right in front of our eyes. We are already beginning to get the yield in. It’s already depositing them into your account.

Martin: The yield on the screen is what I’m getting paid right now. And that’s on the entire amount we deposited, not just on the half that’s in stablecoins, right? Both of them are generating this yield.

Marko: Right.

Martin: And that’s before any profits I might make on the Solana. So, if Solana goes up in value, I can make even more?

Marko: Yeah, a lot more.

Martin: And you’ve already cherry-picked the highest possible yield available?

Marko: No, not at all. I’ve selected a pair with a yield at the low end of the list.

Martin: The low end of the list? Really? Show me that.

Wow, it even goes up to 282%?!

Marko: Impressive, I know. But watch out! Once you go out into these stratospheric levels, you’ve got to really make sure you’re not getting into a can of worms.

Martin: I love the idea of these pairs.

The only corollary in the traditional investment world I can think of is something like 50% of your investment in a company’s short-term debt, like commercial paper, and 50% in the company’s dividend-paying shares.

But even if you invested in a company with a low rating, the yield on the commercial paper would still be less than 1%.

And even if you invested in its shares, there’s no way you could get 40% yields unless it was some anomaly like a company on the brink of Chapter 11, or worse.

Simply put, there’s absolutely NO WAY I could get a deal like this in traditional asset markets.

But here’s a question for you, Marko …

Why did you select a lower yield when you could have selected a higher yield? The higher it is, the more I can make, right?

Marko: In theory, yes. In practice, I’m not so sure. Yes, I can find you opportunities to earn crazy high yields. And once in a while, I might find something that you could take a fling with. But it will be rare.

So don’t count on it. Better to buy more solid pairs, like the pair we just bought yielding 40%.

Martin: Okay, we’re better off going for 40%, which should be more solid than going for the 200% or 290%, which is very risky. But let me ask you this…

Suppose I WANT to prioritize profits instead of yield?

Marko: Now, that’s what takes us to Level 3.

Then, I’m going to select a crypto pair that has the single most attractive profit opportunity.

Or I’m going to select a single crypto that our team and I believe has THE best chance of going through the roof in value. You know what I mean, right?

Martin: Of course. I actually have some good examples of that right here.

Chainlink, which Juan and team first recommended in June of last year and is now up 443%.

Bitcoin, which they recommended in April of 2019 and is now up 999.9%. Almost 1,000%.

Ethereum, which they recommended in April of 2020, now up 1,834%.

Or Cardano, which they recommended in November of 2019, now up 5,522%.

But, that’s an extreme example and we shouldn’t forget we could lose money, too, right, Marko?

Marko: For sure. And going for pure profits is not my main goal. My main goal is big yield. The profit opportunities are just an extra bonus.

Lots of people spend their whole life working for money. My main goal is to help make your money work for you.

Martin: I’ll be happy if I can just continue getting the 19.5% yield on Level 1. And the 40% yield on Level 2 would be great too! That’s fantastic.

Marko: It just takes setup and a watchful eye. So, I’ll be watching your account like a hawk. If anything changes with your two deposits, I’ll let you know.

If I see new, similar opportunities, I’ll let you know.

What’s even more likely is that I’ll see a whole series of even better opportunities. I’ll urgently let you know about those too, Martin.

As for the pure profit opportunities? That’s when you really need to be alert. Because those can come at almost any time.

Martin: I appreciate that. Given the crappy interest rates out there , this is so timely, and I’m so glad you’re helping me navigate this new world of income.

I know you’ve got to run to make some trades. So, go ahead and place your trades, while I talk to our friends for a few more minutes.

Marko: All right. See you, Martin!

Martin: I must say Marko is amazing. He’s part of our team of crypto experts who know this DeFi world like the back of their hands.

But when it comes to hunting down yields that are huge and reliably solid, I know of no one who can do a better job than Marko.

A Word of Warning

I’ve got to warn you about one thing, though.

It’s not quite as easy as Marko makes it sound. For him, yeah, sure. But for people who have never done it before? Not so easy.

To get these kinds of yields, it’s not as simple as walking into your local bank or placing an order with your online broker.

The DeFi market is an entirely new financial ecosystem and sometimes, it’s just not user-friendly.

That’s one of the main reasons why so few people know about it. It’s why even fewer people know how to do it. And it helps explain why the yield — and the profit potential — are so huge.

But hey! It wasn’t long ago that you could have said exactly the same thing about guest what!

Bitcoin.

Few people knew about Bitcoin in the early days. Fewer still knew how to buy it. That’s one of the main reasons it sold for pennies.

And that’s also the reason some people, who got in early, are now Bitcoin billionaires.

So, if you want to earn the kinds of yields that Marko just showed us …

If you want to go for as much as 19.5% at Level 1 with little or no price risk …

If you want to go for at least 40% at Level 2, this time WITH price variations on half your investment …

If you want to go for pure profit potential on Level 3 …

Then it’s going to take some effort to set up your accounts and to learn how to do it.

But I tell you, it’s worth every minute of your time.

The yield and profit opportunities are literally out of this world, an entirely different financial system — Decentralized Finance.

The good thing is that once you’re set up, you can use pretty much the same setups over and over again.

Then, it gets a lot easier to hunt down rich yields and profit opportunities week after week.

The High Yields and

Profit Potential Are

Out of This World

Bonds, real estate, private lending, dividend-paying stocks — nothing delivers the yield opportunities that are even close.

However, I do want to point out that there ARE important differences between the traditional world of finance and Decentralized Finance.

In the traditional world, most things you might invest in — CDs, notes or bonds — have fixed yields until maturity. In the DeFi world, the great majority of the yields are variable.

But that’s usually a good thing.

Because it means you’re never locked in. If you see a better opportunity, you can switch any time.

Here’s another big difference:

In the traditional world, one of the first things a prudent investor should ask is:

What happens if the company or even a government defaults?

Suppose they fail to pay me the interest they owe you. Or worse, suppose they fail to return your principal.

Who or what is backing it up?

But in the world of Decentralized Finance, it’s often a moot point. There is no company. There is no government. So, there are no entities to fail in the first place.

Virtually the lending and borrowing is peer to peer.

And almost everything is rigorously enforced by the computer code itself, especially when it comes to collateral.

In fact, anyone who wants to borrow money always has to put up collateral that’s MORE valuable than the money they take down.

In the fractional banking system, collateral is always a lot LESS than the money they borrow.

So, what happens if crypto borrowers don’t have enough collateral or the market value of their collateral goes down?

Then, their positions are summarily liquidated. No questions asked.

Harsh? Sure!

But if you’re earning yields, that means you’re the lender, not the borrower. So, for you, that’s the best-possible way to make sure your principal is sound. And it works.

Heck, in some ways, it’s MORE secure than virtually anything we have today in the traditional world of banking and finance.

Here’s the last difference: In the traditional world, when people invest in a CD or a bond, most don’t seem to care about the value of their currency.

I don’t think that’s a good idea.

You SHOULD care about how much your money is going to be worth in the future. That’s true for the pound, the euro, the Swiss franc and the yen. And, it’s especially true for the U.S. dollar.

You should care because central banks have trashed our currencies with massive money printing.

You should care because of how inflation is now going through the roof.

Heck, in the DeFi world, everyone cares about the value of the currency.

That’s why they’ve invented stablecoins and that’s why stablecoins are now so huge.

It’s why Tether (USDT), the first major stablecoin, is the #4 largest cryptocurrency in the world, with about $70 billion in market cap.

It’s also why Tether is the #1 most actively traded cryptocurrency in the world, with more trading volume than Bitcoin and Ethereum combined!

And it’s why there are so many other strong cryptos that now compete with Tether. All stablecoins. All pegged to the dollar. And most of them great for making big yields with little or no price risk.

Suppose the Dollar Itself Falls Sharply. Then What?

Well, that’s why it can also be a good idea to invest some of your risk funds in cryptos that are NOT pegged to the dollar, that we believe have the best potential to surge in value.

Ideally, like these trades we recommended.

Like Bitcoin up 1,000% that turned $10,000 into more than a $100,000 investment.

Like Ethereum, up 1,834%, turning $10,000 into $184,000.

Like Cardano up 5,522%, turning $10,000 into over a half-million-dollar investment.

The U.S. dollar’s purchasing power, as measured by that Bitcoin position of ours, is already down to just ten cents on the dollar.

What about the dollar’s purchasing power measured in terms of our Ethereum position? It’s down to less than six cents.

And in terms of that Cardano position of ours? The U.S. dollar is down to less than two cents.

That’s right. If Cardano were the world’s standard currency, the U.S. dollar would be worth just two cents today compared to only three years ago.

Billions of Dollars Are Pouring

Into This New World of Finance

This explains why billions of dollars are pouring into the crypto market from investors all over the world. They’re sick of a financial system abusing their money and their trust.

Today, Marko showed us three amazing yield and profit opportunities.

The first one was to earn pure yield …

19.5%!

The second one was to earn pure yield on half the deposit and to go for both yield and profit on the other half. In other words, a healthy mix of the two.

The yield alone was 40.3%.

That gives me the potential to earn $4,000 on every $10,000 I deposit. And it gives me the additional opportunity to go for a major profit.

The third one was going for big profits in fast-growing cryptos.

But what we saw today was just to get me started. They’re just a sampling of the yield — and profit — opportunities available in the DeFi world today.

There are multiple different websites you can use, some recommended, some not.

There are multiple crypto wallets you can download, some recommended and some not.

There are many different kinds of crypto tokens to get you in the door, some worth owning, some not.

You need to approach each of these new opportunity with a healthy amount of due diligence and scepticism.

Can you do it on your own? Perhaps.

Just bear in mind that, no matter how much experience you may have, if you want to avoid the pitfalls and find the most reliable platforms with the best yields, it’s going to take a lot of work to hunt them down, to separate the good from the bad.

To take advantage of the full range of high-yield and profit opportunities, I recommend you get continuing guidance from our team of crypto experts. So let me tell you something about us and what we do.

I started my research and ratings company in 1971, over 50 years ago. Unlike all Moody’s, S&P and Fitch, we’ve never accepted any compensation in any from the companies or investments we rate … and we never will. We are 100% independent and unbiased. Our very first priority is investor safety. And all this helps explain why our research and ratings are so accurate.

This is why Esquire magazine wrote that “Weiss Ratings is the only one providing grades with no conflicts of interest.”

It’s why The Wall Street Journal reported that “Weiss stock ratings ranked #1 in profit performance.”

It helps explain that why the New York Times reported that “Weiss was the first to see the dangers [of a major financial crisis] and say so unambiguously.”

Now, our interest in Bitcoin began in its early days, about a decade ago. That’s when a Weiss executive was offered 200 Bitcoins stored on a small pen drive. Back then, it was just a gift, barely worth a nice lunch for four. Today, that small, friendly, gift would be worth about $10 million.

A few years later, one of our Weiss analysts explained the amazing future of Bitcoin to a relatively small group of our readers.

If each of those readers had bought just one Bitcoin at that time, they could have made over $1.4 billion in profits, collectively.

And these are just a couple of the examples of how my team took an early interest in Bitcoin — and how Bitcoin has created, or could have created, thousands of instant millionaires and even a few billionaires.

But there’s more. You see, that’s when we embarked on a monumental new project: to develop the world’s first and only cryptocurrency ratings.

At that point in time — late 2017 and early 2018, investors all over the world were going absolutely nuts for Bitcoin.

Crypto markets were in bubble-land, grossly overpriced and extremely risky.

So, our new crypto ratings naturally reflected that. And when we issued our first ratings, not a single crypto got an “A.” Bitcoin got a mediocre rating, and most of the cryptos we rated got “Ds” and “Es.”

So, our message to investors was absolutely clear: “Stay away or get the heck out.”

Bitcoin lovers around the world erupted in rage. They even mounted a cyberattack on our Weiss Ratings website.

Fortunately for us, the attack failed. But unfortunately for Bitcoin owners, we were right: Bitcoin crashed and investors who failed to heed our warnings saw their portfolios lose most of their value.

Then, one year later, on December 12, 2018, when the price of Bitcoin was about to hit rock bottom … that’s when we announced to the world that it was finally time to start buying Bitcoin again!

Our announcement went viral.

Coin Intel News broadcast it all over the internet, and they said:

“Weiss Ratings calls the bottom.”

Bitcoin News wrote …

“Weiss Ratings declares now best time to buy Bitcoin.”

Countless blogs and websites picked it up, too. And sure enough, three days later, Bitcoin hit rock bottom, and that was the end of the crypto bear market of 2018.

So now, the crypto crowd doesn’t hate us anymore.

One crypto commentator wrote:

“Your transparent and unbiased ratings will bring light to the darkness and murky crypto world.”

According to MyIndex Solutions, a VanEck company, the “Weiss Crypto Ratings outperformed the aggregate averages with compelling diversification benefits.”

Forbes, CNBC, Fortune, The Motley Fool and many others told their readers about the importance of the Weiss Crypto Ratings.

And crypto blogs all over the world have praised our Weiss Ratings experts for their uncanny accuracy in pinpointing the best cryptos to buy … and the right time to buy them.

Now, the fast-forward to the new world of DeFi, and I’m proud to say we’re again far ahead of the crowd. We were the first to rate DeFi coins … and among the very first to steer our readers to the new world of high yields that DeFi offers.

A world that has grown 100-fold just since 2020 and could continue grow at that pace in the months ahead.

A world that has already generated, by far, the greatest yields and the greatest profits of any sector of any economy on the planet today. And that’s still in its very early growth stage.

A world that has the potential to grow far more in the years ahead. Look, the global financial system has $400 trillion in assets. If the decentralized financial system can compete with or replace just 10% of that, it will have $40 trillion in assets and it will have enjoyed a 400-fold growth.

All by cutting out the middleman in financial transactions. All by simply giving billions of people around the world the opportunity to make a decent yield.

So, if you’re ready to jump on this opportunity, arguably the largest we’ve seen since the birth of Bitcoin, here are the five steps I recommend right now:

Your first step is to protect your savings from intermediate market crashes — not only in the stock and bond market … but also in cryptocurrency markets.

It’s easy. Simply buy stablecoins, and I’ll name two in just a second.

Remember, unlike other cryptocurrencies, stablecoins are designed not to fluctuate hardly at all in value. They are pegged one-to-one to the dollar.

Your second step is to deposit your stablecoins to earn the high yields that only stablecoins can offer.

In fact, no other vehicle that I know of in the world today offers this combination of stable market value AND unusually high yield at the same time.

If you live in the United States, you can open an account with the Gemini exchange. Then you can buy Gemini’s stablecoin, called the Gemini Dollar (GUSD), and you can go for high single-digit interest rates. Last we checked, they were paying about 8%.

Or, if you live overseas, you can open an account with Binance.com, not to be confused with Binance.US, and you can get similar interest with their stablecoin called Binance USD (symbol BUSD).

Step #3 is to go for the 19.5% yield that Marko demonstrated. That’s 15 times more than what you can get from stock dividend yields on the S&P 500 stocks. And it’s 67 times more than the average yield on five-year jumbo CDs, the highest-yielding kind of deposits offered by U.S. banks.

Now, the exact yield you get may differ, but as Marko said, in the last six months, the yield has been relatively stable between 19% and 20%.

But, unlike the lower Gemini or Binance yields, this one is more difficult to access without guidance. So, to help get you there, we’ve prepared a free step-by-step guide, How to Avoid Crashes and Earn 19.5%.

In a moment, I’ll give you the opportunity to download your free copy.

But first let me say this: I feel that each of the steps we’ve discussed so far — steps 1, 2 and 3, is appropriate for savings, for money you cannot afford to lose in a sharp market decline — and that’s because they involve strictly stablecoins without depositing any cryptocurrencies that are subject to significant price fluctuations.

I would not deposit ALL my savings in DeFi because it’s still new and relatively immature. But I think it’s definitely worthy of some portion of your savings.

Step 4 now is not for your savings. It’s for investment funds you can afford to risk. But, by simply taking this extra step, you can aim for even higher yields, ranging from about 35% to 65%. Plus, on top of that yield, you also have the opportunity for large capital gains.

All this is very possible with crypto pairs, the crypto pairs Marko demonstrated for you. Half of your money goes into stablecoins; the other half goes into variable-price coins. Just follow the step-by-step instructions in your other free guide, titled How to Go for up to 65% Yields with Crypto Pairs.

Step 5 is for your speculative funds, money you can afford to lose, in order to take advantage of the big profit bonanza available with our highest-rated cryptocurrencies.

As I mentioned earlier, our lead crypto analyst, Juan Villaverde, recommended Bitcoin in April of 2019, and last I checked it had surged 999.9%. Almost 1,000%.

He recommended Ethereum in April of 2020, and it surged 1,834%.

Cardano, which he recommended in November of 2019, surged 5,522%.

The best cryptos to buy today are not the same, necessarily. But Juan names them for you in our special report, Three High-Rated Cryptos with 1,000% Profit Potential, which you can also download for free right now.

Step 5 is probably the most important: Stay in touch.

You see, those stablecoin yields on your savings … they can change. So, from time to time, you may want to shift your funds to go for higher-yielding deposits elsewhere.

On your investment money, both the yields and prices can change. So, it’s not a set-and-forget investment.

And for your speculative funds, never forget that crypto markets can be very volatile. So, it’s important not only to select the cryptos that get our highest ratings, but also to know when to buy and when to sell.

Currently, we rate over 1,000 cryptocurrencies. And our track record demonstrates that we are among the world’s leaders in picking the major tops and bottoms of the crypto market.

Now, normally, each of our three guides retails for $79, or $237 for the set.

But you get them at zero cost when you accept a risk-free trial to Weiss Ratings flagship newsletter on cryptocurrencies, called Weiss Crypto Investor.

Each month, Weiss Crypto Investor brings you fresh opportunities to go for high yields and big profits from the brightest crypto experts I’ve ever met.

For yield opportunities, we tap Marko Grujic, the DeFi expert you met today.

And for profit opportunities, Juan Villaverde is the man. Juan is the lead architect of our crypto ratings model. He’s also the expert who recommended Cardano back in December of 2019 for pennies and helped investors make 54 time their money — and counting!

Every month, we will alert you to stablecoins that offer the highest yield AND to variable-price coins that could be poised for exponential growth.

We’ll also warn you away from hyped-up cryptos that look good on the surface, but [that] you shouldn’t touch with a ten-foot pole.

And each month, you’ll get Juan’s latest forecasts about the broad crypto market, plus the hottest recommendations to position yourself for maximum profits right now.

Look — normally, one year of Weiss Crypto Investor retails for $268.

But if you click on the button below now, we’ll send you 12 monthly issues for just $39.

That’s only 10 cents a day — probably less than what’s in the cracks of your couch.

And when you join now, we’ll also give you immediate access to download all four reports with the specific instructions on how to go for the highest yields and the biggest profits available today.

All as my thank-you for giving Weiss Crypto Investor a try.

It's everything you need to jump in now and begin exploring the world of decentralized finance right away.

Still, though, in the fast-moving world of crypto, I think it’s also important to stay up to date with the latest news daily. So, with that in mind …

I will give you a free subscription to our Weiss Crypto Daily. This is the e-letter we publish five days a week, Monday through Friday.

You know, the crypto world moves faster than practically any other market on the planet, so our Weiss Crypto Daily keeps you on the cutting edge of all things crypto.

Our team of crypto experts alert you to up-and-coming opportunities. We warn you about the scams and misinformation. We provide our unbiased responses to the breaking crypto news of the day.

Plus, I have one more important gift I think you’ll absolutely love and that’s absolutely priceless.

Almost every Sunday of the year, we’ll give you access to a special video interview with our crypto experts, exploring crypto trends and profit opportunities that you cannot get from any other source.

They’ll give you the latest on our crypto ratings. They’ll give you the latest on our crypto timing model, and the latest on these stable coins that can earn so much in yield.

If you’re not absolutely thrilled with the money our recommendations can make for you, just let me know and I’ll rush you a full refund, no questions asked.

I’ll give you back every penny you’ve paid for your membership, and you can still keep all your special reports and videos — my gift to you. Even if you cancel on the very last day.

All told, you get $466 in free gifts and discounts.

Click the button below and join now for just 10 cents a day. Go for some hefty profits. And save $466, including all five of my free gifts to you.

Gift #1. How to Avoid Crashes and Earn up to 19.5%

Gift #2. How to Go for up to 65% Yields With Crypto Pairs

Gift #3. Three High-Rated Cryptos With 1,000% Potential

Gift #4. The Weiss Crypto Alert, five days per week

Gift #5. Weiss Crypto Sunday Special, Crypto Focus — our weekly video interviews with our crypto experts

My friend, we’re living in a unique moment in time, a moment when the very nature of money and finance is undergoing drastic change — for the better.

If you want to escape the world of near-zero interest rates …

If you want to protect the value of your savings from surging inflation …

If you want to be a part of this great money revolution to help secure your wealth far into the future …

If you’re not thrilled with the money our recommendations help make for you, just let me know and I’ll rush you a full refund — even if it’s the very last day of your membership.

And you can keep all your gifts — my way of saying “thank you” for giving Weiss Crypto Investor a try.

This is Martin Weiss, founder of Weiss Ratings, thanking you for your time, and hoping to see you here again very soon.