Three New Undiscovered Cryptos

Bigger Than AI. Bigger Than Bitcoin.

Up to 500x Growth Projected.

With founder Dr. Martin D. Weiss and

lead crypto analyst Juan Villaverde

MARTIN WEISS: Hello and please accept my heartfelt welcome to this urgent, private conference about new undiscovered cryptos exclusively for like-minded investors.

It’s urgent because the most profitable phase of the crypto bull market has just begun. And it’s private because the best opportunities in the crypto world are not for the crowd.

Already, since hitting rock bottom, Bitcoin has more than tripled, and historically, Bitcoin has actually been among the least profitable of our high-rated coins.

In the last cycle, from the day we called the bottom, Bitcoin rose 20 times. Ethereum rose 54 times. Cardano rose 102 times. Another one of our favorites rose 234 times. And newer names enjoyed even greater gains.

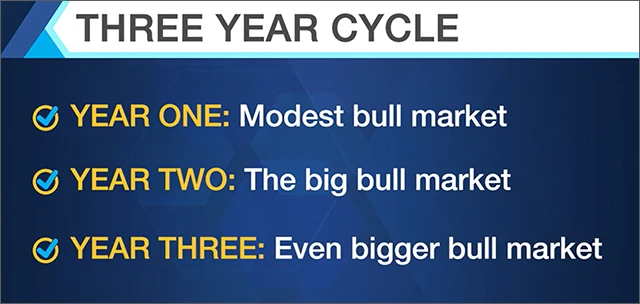

My guest today is Juan Villaverde, the man who famously made those calls, and as he’s proven to us — many times in many ways — that crypto bull markets have always lasted three years.

Year one is the transition from bear to bull, as the market begins its ascent.

Year two is the big bull market.

And year three is an even bigger bull market.

Right now, we’re just at the beginning of year two, and like I said, Bitcoin has already more than tripled.

But if you missed it, don’t let that bother you.

Using history as a guide — and we think a very reliable guide at that — we can say, with confidence, that this past year was just the first inning of a far bigger ball game.

In fact, now is actually one of best times to start investing. Why?

Because the rise of the past year tells us we’re on the right track. And at the same time, history tells us that far more money can be made in the next two years.

Consider the story of two hypothetical investors, John and Mary.

John is among the first investors to buy — right near the big bottom. But he gets out too soon. He jumps ship after the first year.

Mary waits. She doesn’t start investing until after the first year. And she holds on till the end of the ride.

So, how do their results compare?

Well, the last cycle gives us the most relevant data. John does pretty well. He sees a gain of 183% in Bitcoin, 118% in Ethereum and 49% in Cardano.

But Mary beats John by a country mile.

In Bitcoin, she makes 3.5 times more than John.

In Ethereum, she makes 21.5 times more than John.

And in Cardano, she makes 102 times more than John.

Mary proves that missing the first year is not a big deal at all.

Not only that, with the market clearly headed north, she’s able to invest with greater confidence that she’s on the right track.

So, she’s comfortable investing a few bucks in new undiscovered cryptos that didn’t exist before.

She finds one solid crypto with innovative tech and a great marketing team. She buys it for 1.4 cents and sees it surge to $1.89, a gain of 13,692%.

Let’s call that the New Crypto Wonder #1.

At the same time, she makes 22,179% on New Crypto Wonder #2 …

She makes 26,132% on New Crypto Wonder #3 and

Look at this one: 57,421% on New Crypto Wonder #4.

These are extreme examples. But there are others which go up even more than that.

Here’s the most intriguing thing of all: Mary discovers that …

Many of the most interesting coins aren’t listed yet on major crypto exchanges like Coinbase or Kraken.

Instead, she buys them a different way.

A 55-Fold Gain Instead

of a Nine-Fold Gain

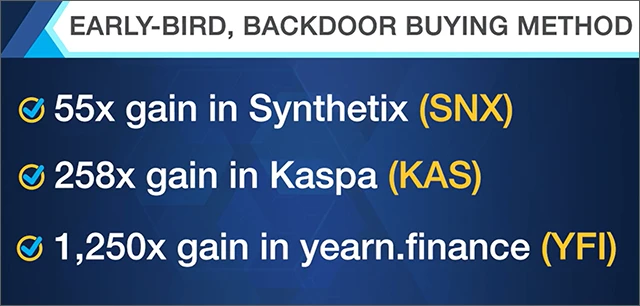

For example, consider a relatively popular crypto called Synthetix, symbol SNX. And look at the huge difference this can make.

When John logs onto his account at a major U.S.-based crypto exchange, he doesn’t find Synthetix. It’s not listed yet, and it only shows up months later. That’s when he buys it, paying $2.82 per coin.

Within half a year, Synthetix goes up to $26.50, and John makes more than nine times his money. That’s darn good.

But Mary doesn’t wait for Synthetix to be listed on a major exchange. Instead, she uses our early bird buying method, a special way to buy we’ll tell you more about in a moment.

Thanks to this early bird buying method, she’s able to buy Synthetix for much less.

Instead of paying $2.82 per coin, she pays only 48 cents. That’s an 82% discount off what John gets it for later.

And instead of multiplying her money by “merely” nine times, she multiplies her money by over 55 times.

I repeat:

A 55-fold gain instead of a ninefold gain.

Or, consider this second trade, yearn.finance (YFI) …

1,250x Instead of 10x

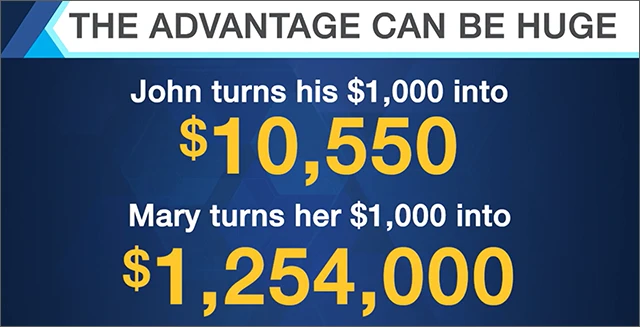

John buys it on the first day it’s listed on a major exchange. By then, it’s already very pricey, at $4,106 per coin.

But 33 days later he sees it surge to $43,338 — a gain of 955%. Not bad for one month’s work.

Mary does not wait for yearn.finance to be listed. She gets in with our early bird buying method and pays just $35. That’s 99% less than what John paid.

Instead of a 955% gain, she sees a gain of 125,336%. In other words, not just 10 times her money like John, but 1,250 times her money.

How much money might that be? Well, if they each invest $1,000, John makes $10,550, while Mary makes $1,254,000.

Big difference.

258x Instead of 2x

Or look at the new crypto wonder, Kaspa, and go back to May 6, 2023. That’s the day Kaspa was first listed on a major exchange.

On that day, John buys Kaspa and watches it nearly double. Good.

But one year earlier, on May 25, 2022, to be exact, Mary uses our early bird buying method and buys it for 97% less.

Instead of nearly doubling her money, she makes 258 times her money.

So, Mary makes a lot more money in two ways. She rides the biggest two years of the bull market. And she gets in for a lot less by using our early bird method whenever possible.

All this raises …

Some Urgent Questions for Investors

First, what’s driving this new wave of wealth creation and is it sustainable?

Second, what specific steps should you consider taking right now?

Juan Villaverde, our lead crypto expert, is here to give us the answers.

Juan not only developed our Weiss Ratings Model, which he uses to help pick the best of the best … but he also created our timing model, which he uses to pick the big bottoms and tops.

And today he’s here not only to tell us about the cryptos that enjoyed such spectacular gains last time around, but, more importantly, also to tell us about the new undiscovered cryptos he predicts could enjoy the most spectacular gains this time around.

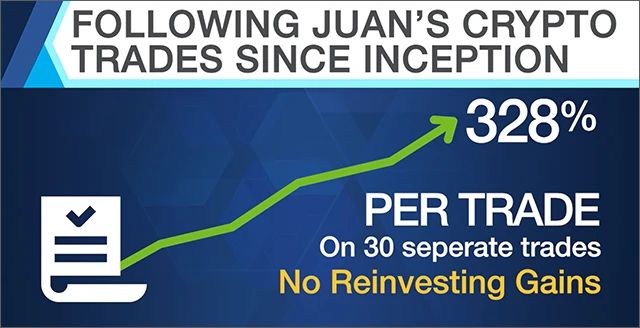

If investors strictly used his monthly publication and simply followed Juan’s cryptocurrency trades since inception, they could have seen an average gain of 328%.

That’s right. On average, they could have made 328% gains, more than four times their money.

Per trade. On 30 separate trades. Without reinvesting gains.

No cherry-picking. No backtesting. No mathematical maneuvers. Juan’s track record is based strictly on real signals issued to investors in real time.

Congratulations, Juan! So glad you could be here with us today!

Juan Villaverde: I just flew in.

Martin: For the wedding, you mean.

Juan: Yup, day after tomorrow. But it’s not my wedding.

Martin: Yours will be when?

Juan: Very soon.

Martin: So, that makes two separate congratulations for you! One for the great track record helping our members make money in crypto through thick and thin … and one for your happy day coming soon.

Juan: Actually, those two things are not so separate. If it hadn’t been for the money I’ve made in crypto, maybe I wouldn’t be getting married now, or maybe it would be a less expensive wedding.

Martin: Who can say for sure, right? Fate has strange twists and turns.

Juan: Yes, and one of the strangest ones of all is what the so-called “veteran experts” on Wall Street think about Bitcoin. You see, the opportunities are amazing. But what’s even more amazing to me is that, despite the huge wealth Bitcoin has helped create …

Martin: … and despite the 328% average gains per trade you’ve achieved …

Juan: Right. Despite all this, the most famous “experts” in the investment world still don’t get it.

Martin: I know exactly what you’re talking about, Juan. Just recently, for example, Warren Buffett said, “If you told me you owned all of the Bitcoin in the world and offered it to me for $25, I wouldn’t take it.”

But Buffett doesn’t dare compare the profits in Bitcoin to how much investors could have made in his own company.

If you had invested $100 in Bitcoin when it first started trading publicly, you could have more than $70 million today, and that’s even before this bull market really picks up steam.

At the same time, someone who invested $100 in Buffett’s Berkshire Hathaway shares would have about $700 today.

The money you could have made in Bitcoin is not just double or triple, not just 10 or even 100 times more. It’s 10,000 times more.

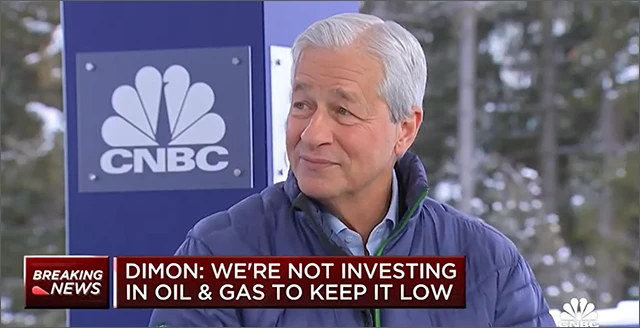

Meanwhile, Jamie Dimon, CEO of America’s largest bank, says, “Bitcoin itself is a hyped-up fraud.” But it seems Dimon himself likes to bet on things that could be seen as worse than hyped-up frauds.

I say that because Jamie Dimon’s bank, JPMorgan Chase, shelled out $10 billion to buy First Republic Bank, and First Republic Bank was the biggest bank failure in America since the Great Financial Crisis.

I know it sounds crazy, but it gets worse. So, let me share my own research with our viewers on how this all ties together, OK.

Juan: Sure.

Martin: You see, there are also other powerful people who are big Bitcoin skeptics. In fact, three Federal Reserve chairs — Ben Bernanke, Janet Yellen, Jerome Powell — seem to be in the same camp.

But even as they fuss and cuss about Bitcoin, they’re destroying the U.S. banking system by wiping out any semblance of decent yield that 110 million Americans can hope to make. In fact, the average savings account in U.S. banks is paying a miserly half percent.

To hell with that! Instead, for my own money, I want to move some of it to deposits in the crypto world. The deposits are pegged to the U.S. dollar. They have very minimal market price risk. And the interest rates are far higher.

Juan: Sure. Everybody wants to get higher interest rates than they can get in the traditional banking system. And they also want the kind of big profits that only crypto has been able to deliver.

All available right now in the new crypto world called decentralized finance or DeFi.

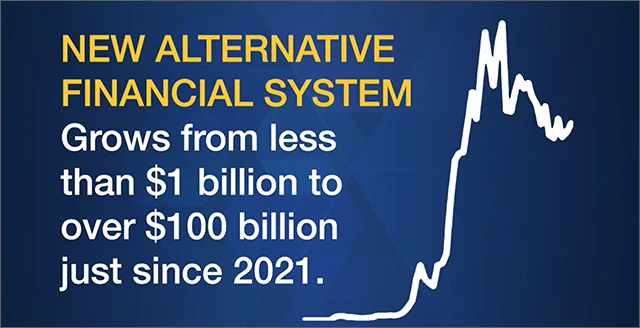

Martin: And it’s grown tremendously, right?

Juan: Yeah, absolutely. This is a brand-new financial system that has emerged from the very same Bitcoin invention that Buffett, Dimon, Bernanke, Yellen and Powell seem to deplore so avidly.

Martin: So, tell us about how it’s grown.

Juan: Not long ago, decentralized finance had less than $1 billion in deposits. Now, it has over $100 billion in assets.

It’s growing so fast. It’s already so big. It’s already a big driver of this bull market. And it could be a massive new opportunity for investors.

Martin: Why so massive?

Juan: Because the traditional financial system is so unfair, so shaky and so huge. The total assets in the traditional financial system today are over $500 trillion.

If decentralized finance can compete with, or replace, just 10% of traditional finance, it will have $50 trillion in assets.

That’s about 500 times more than it has today.

Martin: So, you’re talking about 55 times growth potential from where it is today.

Juan: Correct.

Martin: Tell us how to profit. Walk us through the same basic steps you follow.

Juan: There are three steps, essentially the same steps I used for those 30 trades with average gains of 328% per trade.

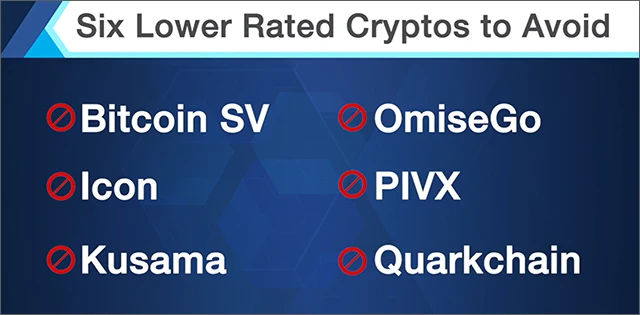

Step 1 is to use our Weiss Crypto Ratings to help avoid the garbage and select only the best of the best, the cream of the crop in the world of crypto.

We currently rate hundreds of cryptocurrencies, and most of them get bad grades. But let me name just six low-rated cryptos which are among the worst coins investors often get sucked into:

- Bitcoin SV

- Icon

- Kusama

- OmiseGo

- PIVX and

- QuarkChain

Don’t touch these coins — not even with a ten-foot pole.

If you do nothing more than avoid the cryptos with our lowest ratings, I think you should be able to cut risk by a wide margin.

And needless to say, the bigger benefit of using our ratings is to help pinpoint the coins with some of the best profit potential.

Martin: Which ones?

Juan: One of my top two favorites is the crypto I call “The Great Money Integrator.”

This is the one that, in the last cycle, rose 234 times, or 12 times more than Bitcoin. No one can say for sure what it will do in this cycle. But even if it goes up only one-tenth as much, it could easily move the needle in almost any portfolio.

Martin: Why is that? Why does it have a good chance to succeed, in your opinion?

Juan: Here’s why I think it has a good chance to succeed …

Remember: Right now, as we speak, the world of finance is undergoing massive change, and a big part of that change is a shift from traditional finance to decentralized finance — from bank deposits that rip us off to stablecoin deposits that give us excellent yields.

Martin: Do you think that changes will be sudden and revolutionary, leaving massive bank failures in its wake? Or will it be gradual and evolutionary, bringing lasting benefits to both sides?

Juan: Probably a mix of both. But the way I see it, no matter how this change unfolds, sooner or later, the big banks of the world must connect to the blockchain. And sooner or later, the big blockchain networks must connect to the banking system.

And that’s precisely what one brilliant crypto team is doing. Their cryptocurrency, which I call the “The Great Money Integrator,” is at the heart of this project.

All my research tells us that the more banks get connected to the blockchain, the more this crypto will be in demand, driving its price up. And the more blockchain networks get connected to the banking system, the more in demand it will be, driving its price even higher.

Martin: And you’ve just released a special report all about this crypto, “234x: This Crypto Surged 234-Fold in the Last Cycle. Here’s How to Play it in This Cycle.”

Juan: Yes. I tell you where and how to buy it. I also let you know when I think it’s time to sell.

Martin: Which can be even more important than the time to buy, right? Remember, even investors like Mary, who missed buying near the bottom, could have made up to 100 times more money than investors like John who missed selling near the top. That was on Cardano.

I’m looking forward to see how that plays out with the Great Money Integrator. What’s your other top favorite?

Juan: The other crypto I really like is what I call “The #1 Crypto for the AI World.”

Martin: Ah, yes! AI. AI is something I think most investors know a lot about. They know that the world of artificial intelligence is exploding in size. They know it could have a tremendous impact on the world economy.

They may also know that, according to PricewaterhouseCoopers, AI could generate a whopping $15.7 trillion in extra GDP globally by 2030.

Juan: True. But what most people do NOT yet know is this: Where are we going to get the computer power for the trillions of calculations needed for AI?

Martin: Good question.

Juan: The AI world is growing like crazy. And the chipmakers like Nvidia can’t keep up. Plus, we know they’re not going to get that kind of computer power from Amazon, Microsoft or Google.

Martin: Wait, Juan. Amazon, Microsoft and Google are huge. They’re the three giants of cloud computing.

Juan: But they’re already booked solid. They’re already doing everything humanly possible to gear up. There’s no way they can handle the surge in demand for AI computing. I predict that the #1 Crypto for AI will help solve that problem.

Martin: How?

Juan: Their concept is brilliant in its simplicity. Their team has developed a system that can tap the unused processing power of nearly any computer that’s connected to the internet. There’s no way Amazon, Microsoft or Google can mobilize that much firepower for AI.

Martin: And you think the developers behind this little-known crypto can?

Juan: They already ARE mobilizing the unlimited power from countless devices connected to the internet. They’ve been doing it for years. And they’ve done it for a wide range of other things that need heavy computing power. So, I think it’s a no-brainer to do the same thing in the same way for AI computing.

Martin: Connect the dots for us. Show us how all this tech benefits an investor.

Juan: That’s where this gets especially interesting. Every time someone — anyone — wants to buy computing power with this new technology, they have to buy its crypto token.

Martin: You can’t do it with U.S. dollars or euros?

Juan: No, first you have to convert your dollars or euros or whatever currency to buy their token. And needless to say, more demand for the token almost always means more value and a higher price.

Martin: A potential gold mine for investors?

Juan: I think so.

Martin: And you provide all the details in your new report. “The #1 Crypto for the AI World,” which is now available for immediate download.

That’s step 1. Using our ratings to avoid the garbage and pick the best of the best. Now, on to step 2.

Juan: Step 2. Learn how to time the crypto market. Remember: Crypto doesn’t go up in just one continuing bull market. It goes up in 3-year bull market cycles.

Starting in 2012, Bitcoin surged from $68 to $1,100.

Starting in 2015, Bitcoin surged from $200 to nearly $20,000.

Starting in 2018, Bitcoin surged from $3,300 to almost $68,000.

Plus, Bitcoin has already rallied sharply from about $16,000 and, based on our estimates could go to at least $100,000.

Each time, we saw a new, massive bull market that helped create countless new millionaires and even some billionaires.

Martin: But, between each one of these, there was also a big decline, right? So, please explain briefly how you decide when to hop on for the big bull markets and when to hop off before the big declines.

Juan: Sure. I use my Crypto Timing Model, based on cycles. Each year of the bull market is made up of four medium-term cycles. And each of those is composed of four short-term cycles. My computer model identifies those cycles. Everything else, all the volatility in the market, is noise.

Martin: Ever since I’ve known you, I’ve witnessed how accurate it is in real time, and so have your subscribers. But how can we know if your Crypto Timing Model will work in the future?

Juan: Technically speaking, we cannot know. No one can know what the future will bring. All I can tell you is what we’ve achieved so far.

Martin: I’m very proud of that. So let me tell our viewers that story.

Go back to December of 2017, when the prior bull market was ending. Investors all over the world were going absolutely nuts for Bitcoin. Crypto markets were in bubble land, grossly overpriced and extremely risky.

But thanks to our models, not a single crypto got an “A.” Bitcoin got a mediocre rating, and most of the cryptos we rated got “D’s” and “C’s.” So, our message to investors was absolutely clear: “Stay away or get the heck out.”

Bitcoin lovers around the world erupted in rage. They even mounted a cyberattack on our Weiss Ratings website.

Fortunately for us, the attack failed. But unfortunately for Bitcoin owners, we were right: Bitcoin crashed and investors who failed to heed our warnings saw their portfolios lose most of their value.

Then, one year later, on Dec. 12, 2018, when the price of Bitcoin was about to hit rock bottom … that’s when our timing model turned bullish. And that’s when Juan announced to the world that it was finally time to start buying Bitcoin!

His announcement went viral.

Coin Intel News broadcast it all over the internet, and they said, “Weiss Ratings calls the bottom.”

Bitcoin News wrote, “Weiss Ratings declares now best time to buy Bitcoin.”

Countless blogs and websites picked it up, too. And sure enough, three days later, Bitcoin hit rock bottom, and that was the end of the crypto bear market of 2018.

From the day Juan called the bottom of the market on Dec. 12, 2018, to the day the market topped three years later, our highest rated cryptos rose many times over …

Bitcoin rose 20x.

Ethereum rose 54x.

Cardano rose 102x.

And another one of Juan’s favorites rose 234x.

Juan didn’t call the top of that bull market on the exact day. Nor is that the goal of our timing model. The goal is to ride the bull for as long as possible and wait for the market to confirm that the top is in, which happened a couple of months later.

Then, Juan called the bottom of the current bull market, again close to the day. We even held a major conference like this one to make the big announcement to our members.

Now, Juan, looking ahead, what’s the next step?

Juan: It’s step 3. Step 3 is to go for even larger profit opportunities by using our early bird method to get into some of the hottest cryptos that are still virtually unknown and may not even be listed on major exchanges.

This is the time.

This has been precisely the point in the cycle when the best altcoins begin to jump ahead of Bitcoin, begin to move up a lot more than Bitcoin.

Juan: This is altcoin season. Big time.

Martin: Am I already missing it?

Juan: No. Not by a long shot. The cycles tell me these coins are just beginning their big bull market, and they’re easy to buy. You can get them on any major exchange.

And what’s even more exciting is the undiscovered coins that are not so easy to buy.

Martin: Investors might ask, “If they’re not so easy to buy, why bother?”

Juan: I think you made that clear from the examples you cited earlier. It’s precisely because they’re not as easy to buy that most people don’t have access or don’t even know they exist.

And it’s precisely because of these minor barriers that an investor can buy them so cheaply, to get in on the ground floor.

So much so, that I have an expert analyst on my team here at Weiss Ratings that devotes his time to finding these relatively unknown, undiscovered cryptos.

Martin: I know. In some ways, you might say this buying method — this early bird, backdoor buying method — is like having the chance to buy the next Facebook before its IPO.

Juan: Yes, a perfectly legal, reasonable backdoor method for buying cryptos. You don’t need to be an accredited investor. You don’t need to be an industry insider. And you don’t need to get involved with options, futures, margin accounts or any kind of investment that exposes you to unlimited risk.

And the advantage can be huge.

Like John, who makes 9 times his money on Synthetix, while Mary makes 55 times her money.

Not to mention the example in which Jon turns his $1,000 into $10,550, while Mary turns her $1,000 into $1,254,000.

Never forget that these are extreme examples. But using this method to multiply the potential returns is not so rare.

You should also know that our early bird backdoor buying method involves several more clicks of the mouse, several more steps. But for a portion of your money you can afford to take a fling with, I think it’s worth the extra effort.

Martin: To learn how you can buy smaller, undiscovered cryptos before they’re listed on any major crypto exchange, we’ve got a tutorial series “The Early Bird, Backdoor Method for Buying Undiscovered Cryptos Before Other Investors.”

This is our series of easy-to-follow videos that walk you through the steps like one, two, three.

I once tried buying these undiscovered cryptos myself a couple of times, and I can tell you from personal experience …

If you try to do it without a specialized tutorial like ours, it could take you a long time to get set up.

You might stumble from website to website. You might make an easily avoidable error that lands you in the wrong place.

It can be a nightmare.

But with our crypto tutorial, it’s easy and it’s secure. We’ve recorded live trade examples right on your screen. We show you exactly where to go on the web, which buttons to press and what simple precautions to take.

So, you can do it with minimal concerns about making a costly mistake.

You can gain immediate access to the amazing world of these undiscovered cryptos.

And you can have a chance to go for the kinds of profits that we’ve talked about today.

I don't want anyone to think those huge profits are everyday events. And as everyone knows, crypto markets can also go down pretty sharply. But provided you keep these cautions in mind, I think it makes sense to review some of the historic examples we talked about today.

The 55-fold gain investors could have made in Synthetix by buying with the early bird method you learn in these tutorial videos.

The 258-fold gain that could have been made buying Kaspa just this year with our early bird method.

Not to mention the 1,250x gain investors could have made buying yearn.finance, YFI, also with this same early bird method.

Remember, even if investors made just one tenth that gain, they’d still be looking at 125 times their money, or about 12,500% profits.

I presume you don’t recommend investors put all their money in these kinds of cryptos.

Juan: No. Of course not! But with the profit potential they can provide, they don’t have to invest all their money. All you have to do is put up a few hundred dollars and still have the opportunity to make a real difference for yourself and your family.

328% Average Gains from

Real Signals Issued to Real

Subscribers in Real Time

Martin: I think some of our members watching right know are wondering if large profits in the crypto markets are truly possible in the real world.

Juan: For an answer, just check out this example of a crypto that I recommended to investors.

It was Cardano, and I recommended it twice — first on Sept. 12, 2018 when it sold for less than seven cents and then again on Nov. 27, 2019, when it sold for less than four cents.

Martin: At the time, I think the vast majority of investors had no idea what Cardano was all about.

Juan: Most didn’t even know it existed. But I said it was likely to be a shining star in the crypto world.

Sure enough, at the close of trading in 2022, Cardano sold for $1.31, for an average gain of 2,572% on the two trades.

Following my signals on Ethereum, they could have booked gains of 673%, 826% and 1,148%. And following my signals on THORchain, they could have made 1,135%.

Overall, as you mentioned before, if my members simply followed all of my 30 crypto trades since inception, they could have seen an average gain of 328%. Per trade. Without reinvesting gains.

And remember this: None of these numbers I just gave are based on backtesting. They’re all based on real signals I issued to real subscribers in real time.

Martin: Let’s be clear about one thing here. Is this kind of opportunity for keep-safe, emergency funds? Is it for all of your money?

Juan: Absolutely not. But you don’t have to invest a lot of money. If we’re right about the opportunity, it could still make a significant difference in your life.

Martin: What do you see happening right now in the crypto markets?

Juan: Right now, I predict that a lot of new money will flow into the crypto world.

The SEC has approved all 11 spot Bitcoin ETFs, and there's simply not enough physical Bitcoin for all of them.

So, the bigger story is there's going to be massive competition now amongst major Wall Street institutions to source physical Bitcoin. And it means there's virtually unlimited demand for Bitcoin from institutional investors and from more traditionally minded investors.

It means Bitcoin is one of the most restrictive of any asset class that anybody can invest in — in the world. I cannot overstate how limited the actual physical supply of Bitcoin is.

What this all translates into is a surge in prices.

Martin: And that’s just one of the three factors that are converging.

Juan: And on top of that, the new supply of Bitcoin is going to get cut in half, which historically has made the price of Bitcoin surge.

Juan Villaverde predicts:

“This cycle will be one of the best ever in the history of crypto.”

I expect this year cycle to be one of the best ever in the history of crypto.

Plus, I predict that a lot of money will flow from Bitcoin into the smaller, undiscovered projects we’ve talked about today.

The result could be a massive repricing of cryptocurrencies. In other words, I foresee my favorite cryptos going up a lot faster than Bitcoin and other major crypto assets.

Martin: And that would not be a new phenomenon, would it?

Juan: No! It has already happened in every crypto bull market of the past decade. Consider Cardano, for example.

From the day I first recommended Cardano in 2018, through year-end 2021, Bitcoin rose about sixfold. During the same period, Cardano rose about 34-fold. That’s nearly six times better than Bitcoin.

Or compare Bitcoin to yearn.finance which we covered today. On July 18, 2020, when yearn.finance (YFI) first traded, it was worth less than 0.0038 Bitcoin. On Sept. 13, 2020, YFI was worth 4.2 Bitcoins, or 1,100 times more.

Since then, Bitcoin has surpassed YFI. But I think this brings home, again, my point that the world of decentralized finance is truly a sleeping giant.

Martin: Before these new crypto technologies, I never would have said that you can invest just a few hundred dollars today and have anything near the kind of potential that early Bitcoin investors enjoyed. But given the power of decentralized finance, and the 500 times growth potential, I’ve come to believe that this is now possible.

Juan: Not for long, though. Soon, the word will get out. And when that happens, I predict you’re going to see a much bigger flood of money flowing into DeFi, perhaps one of the biggest money flows we’ve ever seen in the crypto world.

Martin: Why are so many investors attracted to this new kind of financial world — decentralized finance?

Juan: A key reason can be summed up in one simple, five-letter word: Yield! You said it yourself: 110 million Americans with a bank account are being ripped off with yields that are far below inflation.

Despite any recent uptick in interest rates, most people are still getting yields of around 1%.

And here’s something else that you did not mention before: For the money people borrow on their credit cards, they’re getting charged more than 20%.

Martin: Right. So, when they deposit $10,000 in a bank savings account, they get less than $100. But when they borrow $10,000, they pay $2,000.

Juan: It just goes to show why there’s massive, pent-up demand for a financial system that cuts out fat cat bankers, which gives people a decent yield, and that doesn’t charge them indecent interest.

It’s huge pent-up demand — not just from millions of people in the U.S., but also from billions of people around the world.

Last we checked, our favorite dollar-pegged deposits in the world of decentralized finance were paying 15.9% interest.

Martin: Wow! That’s three times more than money markets are paying. And it’s 29 times more than you could earn in the average U.S. bank savings account. Are you preparing a report on that too?

Juan: No. I already have prepared a report on that. The title is “15% APR with Stable Cryptos Pegged to the Dollar.”

Martin: I like it because it’s a reputable provider. It has millions of dollars in deposits. And the 15.9% APR is a straight annual percentage rate, even without one-time bonus yields.

All told that gives you a package of four special reports and three videos.

That’s a great value because, normally, each of our four special bonus reports retails for $79. And the tutorial videos are valued at $50 each or $150 for the set.

But you get them all at zero cost when you accept a trial to Weiss Ratings flagship newsletter on cryptocurrencies, Weiss Crypto Investor.

Each month, Weiss Crypto Investor brings you fresh, hot money-making opportunities from Juan Villaverde.

He’s the main architect of our crypto ratings model that helps decide what to buy (or avoid).

And he’s also the creator of our crypto timing model, which helps you decide when to buy (or sell).

Each month in Weiss Crypto

Investor, Juan Villaverde will …

- Alert you to cryptos that could be poised for exponential growth.

- Warn you away from hyped-up cryptos you shouldn’t touch.

- Give you his latest forecasts about the broad crypto market.

- Give you the hottest recommendations for maximum profits right now.

Now, one year of Weiss Crypto Investor is normally $129.

Add it all up and you get a total value of $595. But if you click on the button below now, you save $546!

And you’ll get it all, including one full year of Weiss Crypto Investor for just $49.

That’s less than 14 cents a day — probably less than what’s in the cracks of your couch.

When you join now, we’ll show you how to view all 500 of our Weiss crypto ratings …

We’ll give you the keys to instantly download all four of our special bonus reports.

Plus, we’ll give you immediate access to our three tutorial videos to help you buy undiscovered cryptos before they’re listed on a major exchange.

All as my “thank you” for giving Weiss Crypto Investor a try.

It's everything you need to jump in now and begin exploring the fast-growing world of crypto finance.

Still though, in the fast-moving world of crypto, I think it’s also important to stay up to date with the latest news, daily. So, with that in mind …

I will also give you a subscription to our Weiss Crypto Daily. This is the e-letter we publish five days a week.

You know — the crypto world moves faster than practically any other market on the planet, so our Weiss Crypto Daily keeps you on the cutting edge of all things crypto.

Our team of crypto experts alert you to up-and-coming opportunities. We warn you about the scams and misinformation. We provide our unbiased responses to the breaking crypto news of the day.

Just listen to what others are saying …

“The Weiss cryptocurrency ratings are not based on fashionable trends, friendship or opinions. They’re based on tens of thousands of daily calculations on each cryptocurrency. They are scientific and 100% objective. That’s what gives investors the truly greatest profit potential in several generations.”

—B.C., Editor of Oil & Energy Investment Report

“I welcome that you are now part of the industry, bringing along your analytical mind and fearlessness. Welcome and bravo! It takes a great mind to do what you did in the industry, albeit controversial.”

—U.C.

“You saved me and my father a lot of money back in 1999 and in 2008 by warning us of the cesspool banks and companies that were ready to implode. It’s nice to see you are looking into crypto now. Look forward to following your research and grades.”

—Shawn

Try Weiss Crypto Investor for 12 full months.

If you’re not absolutely thrilled with the money our recommendations can make for you, just let me know, and I’ll rush you a full refund, no questions asked.

I’ll give you back every penny you’ve paid for your membership, and you can still keep all your special reports and videos — my gift to you. Even if you cancel on the very last day.

Click the button below and join now for less than 14 cents a day. Go for some hefty profits. And save $546, including the value of my seven gifts to you:

- Gift #1. Premium Access to Weiss Crypto Ratings.

- Gift #2. 234x: This Crypto Surged 234-Fold in the Last Cycle. Here’s How to Play It in This Cycle.

- Gift #3. The #1 Crypto for the AI World.

- Gift #4. The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence.

- Gift #5. Video Tutorial Series: Our Early Bird, Backdoor Method for Buying Undiscovered Cryptos Before Other Investors.

- Gift #6. 15% APR with Stable Cryptos Pegged to the Dollar.

- Gift #7. The Weiss Crypto Daily, five days per week.

My friend, we’re living in a unique moment in time, a moment when the very nature of money and finance is undergoing drastic change — for the worse among investors who are unprepared, for the better among those who are prepared.

If you don’t want to be a victim of banking rip-offs and even failures …

If you don’t want to be just an observer, sitting on the sidelines …

If you want to be a part of this great money revolution to help protect yourself from financial disasters and secure your wealth far into the future …

Try Weiss Crypto Investor for one full year.

If you’re not thrilled with the money our recommendations help make for you, just let me know and I’ll rush you a full refund, even if it’s the very last day of your membership.

And you can keep all your gifts — my way of saying “thank you” for giving Weiss Crypto Investor a try.

Our team has invested thousands of man-hours and very substantial sums of money to make this possible for you. If you feel this is right for you, please take advantage of it while you can.

Thank you, Juan!

Juan: Thank you, Martin!

This is Martin Weiss, founder of Weiss Ratings, thanking you for your time, and hoping to see you here again very soon.

Good luck and God bless!

Martin D. Weiss, PhD

Founder, Weiss Ratings